Jeff Hupke

The health of the fire apparatus and equipment market may not seem relevant to everyone, but the ability of the industry to turn a profit greatly affects the amount it can spend on product research and development. Better and safer products are very relevant, as they can improve the way firefighters perform their jobs. In this edition of the FAMA Forum, FAMA shares the state of the industry from the point of view of the fire apparatus industry.

Fire Department Survey

Earlier this year, the FAMA Education Committee completed its annual “Industry Outlook” survey. A total of 1,537 North American fire departments participated. Almost 50 percent of the respondents were chiefs, commissioners, or officers. The survey was geographically well distributed, with each of the Canadian provinces and United States represented.

Respondents were slightly more optimistic than recent years, with just more than 40 percent indicating they were expecting to make a major purchase in 2014. Ninety-two percent indicated they expected their major purchase to be an apparatus.

The biggest trends cited include a challenging economy, lack of funding, and reduced staffing. Thirty-five percent of those polled indicated that their standard operating procedures would change, down from 46 percent in 2010. Regarding funding, 32 percent of respondents indicated they had applied for an apparatus grant over the past two years, with three percent noting their applications were accepted. The numbers were 66 percent and 19 percent for equipment grants. Not surprisingly, 56 percent of the departments indicated that helping raise the overall awareness of funding sources was one of the most important actions that FAMA and Fire and Emergency Manufacturers and Services Association (FEMSA) members could take. More than half indicated that they have changed their apparatus specifications because of cost or budget restrictions.

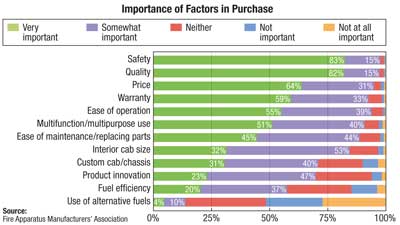

The Education Committee uses the survey to try to identify the most important factors that contribute to choosing apparatus and equipment. As indicated in Figure 1, quality, safety, and price were the top three influencers, while the use of alternative fuels was at the bottom of the list.

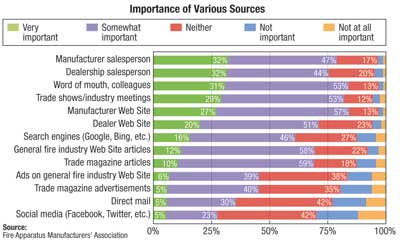

The survey also asked the departments to rate the importance of different sources when they were seeking information on apparatus and equipment. Figure 2 shows that manufacturer salespeople finished at the top, followed by dealers and word of mouth.

Other observations from the industry survey include an increase in vehicle data recorder usage; the majority of respondents indicating that they use foam at some point in their operations; and a slight increase from previous years in respondents that indicated tank size, pump capacity, and cab size would increase over the next five years.

Apparatus and Equipment Provider Survey

Both fire apparatus and fire equipment manufacturers were also surveyed. Even though a higher percentage of company revenues is because of exports, the results indicated an increase in optimism with companies expecting improvements in revenue growth, capital investment, and hiring. The fire industry lags behind the general economy both going into and out of recession, so this is promising news that we may be finally coming out of the 2008 downturn.

Most concerning to member companies were insurance and health care costs. Seventy-two percent indicated they were affected by the economy. The top strategies employed to weather times of economic challenge were diversification (62 percent), exporting (40 percent), higher margin focus (40 percent), and niche market focus (38 percent). Sixty-three percent of respondents were expecting more industry consolidation.

Safety and Quality

It is important to note that the two most critical fire department concerns are safety and quality. This is no real news to FAMA companies, where both these topics stay at the top of our agendas. The other interesting point is that the main connection FAMA companies have with fire department personnel is through their salespeople and their dealers. Listening to the salesforce is one of the key ways manufacturers have of staying in tune with those who use member companies’ products. Whether you choose to work through your local salesperson or contact your manufacturer directly, FAMA urges you to share your ideas and your concerns. Good communication is crucial to our shared passion of improving the fire industry for everyone.

FAMA is again conducting its annual “Industry Outlook” survey and encourages participation from you and your department. Please take five minutes to complete the survey, which can be found at http://www.fama.org/survey.

FAMA is committed to the manufacture and sale of safe, efficient emergency response vehicles and equipment. FAMA urges fire departments to evaluate the full range of safety features offered by its member companies.

JEFF HUPKE was recently elected to serve on the FAMA Board of Directors as the Jr. Director-at-Large. He has been the co-chair of the Education Committee for the past five years and has administered the industry surveys annually during that time. Hupke is currently executive vice president at Safe Fleet, parent company of ROM Corporation, Fire Research Corporation, and FoamPro. Prior to his current position, Hupke was CEO of ROM Corporation and has been with the company for almost 10 years.